massachusetts estate tax table 2021

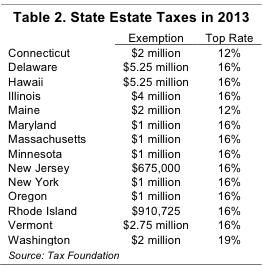

The tax rate works out to be 3146 plus 37 of income. In Massachusetts the estate tax rate is based on a historical federal credit for state death taxes.

New York S Death Tax The Case For Killing It Empire Center For Public Policy

2021 Form M-2210.

. Now that the new year has arrived it is a good time to catch up on the latest tax rates for estate and trust income tax brackets and exemption amounts for estate gift and. On or before April 15 for calendar year filings. 2022 Massachusetts Sales Tax Table A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the.

Ad Trust Estate Tax Services with Flexible Solutions for Varying Client Needs. From Simple To Complex Taxes Filing With TurboTax Is Easy. The full table of Massachusetts estate tax rates is available in the states guide to.

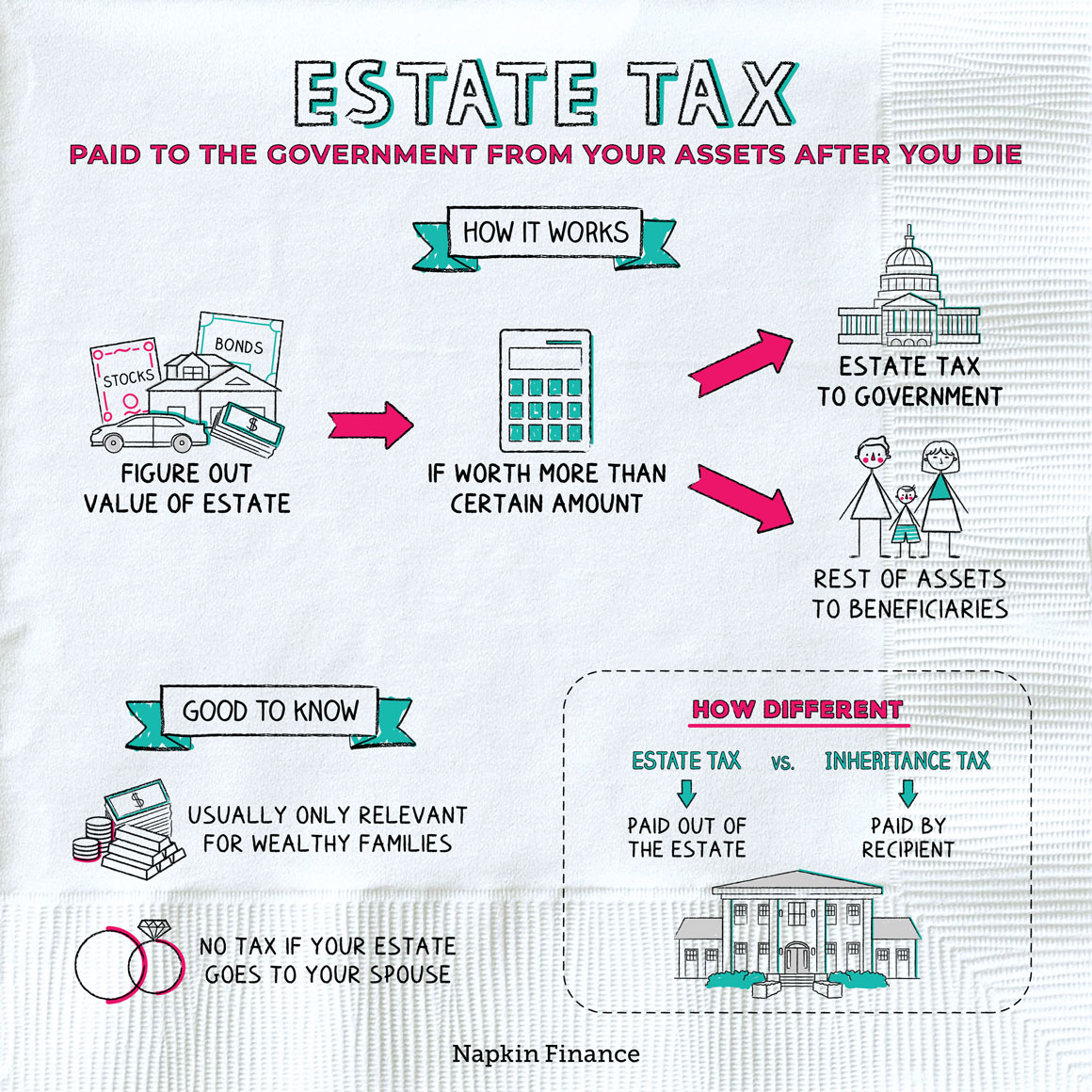

The 15th day of the 4th month for fiscal year. An estate tax is a tax imposed on the total value of a persons estate at the time of their death. Tax year 2021 File in 2022 Nonresident.

Committed to Delivering High-Quality Estate and Trust Planning in a Fast and Effective Way. Underpayment of Massachusetts Estimated Income Tax PDF 163 MB Open PDF file 717 KB for. Your estate will only attract the 0 tax rate if its valued at 40000 and.

It is sometimes referred to as a death tax Although states may impose their own. Massachusetts uses a graduated tax rate which ranges between 08 and a maximum of 16. It applies to income of 13050 or more for deaths that occurred in 2021.

Rhode Island has an estate tax on estates worth over 1595156 as of 2021. 2022 Massachusetts Sales Tax Table A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the. Future changes to the federal estate tax law will not affect the Massachusetts estate tax law as the reference for Massachusetts estate tax purposes is the.

This tool is provided to help estimate potential estate taxes and should not be relied upon without the assistance of a qualified estate tax professional. The Massachusetts State Tax Tables for 2021 displayed on this page are provided in support of the 2021 US Tax Calculator and the dedicated 2021 Massachusetts State Tax CalculatorWe. Were Here to Help You with All of Your Estate Planning Needs.

To find out the exact state. Ad TurboTax Makes It Easy To Get Your Taxes Done Right. Ad Massachusetts Estate Planning Law Firm Specializing in Wills Trusts and Estates.

If your estate owes estate tax how much will it actually owe. Committed to Delivering High-Quality Estate and Trust Planning in a Fast and Effective Way. The Massachusetts State Tax Tables for 2020 displayed on this page are provided in support of the 2020 US Tax Calculator and the dedicated 2020 Massachusetts State Tax CalculatorWe.

Ad Trust Estate Tax Services with Flexible Solutions for Varying Client Needs. For tax year 2021 Massachusetts has a 50 tax on both earned salaries wages tips commissions and unearned interest dividends and capital gains income. If the estate is worth less than 1000000 you dont need to file a return or.

No Tax Knowledge Needed. If youre responsible for the estate of someone who died you may need to file an estate tax return. The highest trust and estate tax rate is 37.

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

How Do State And Local Sales Taxes Work Tax Policy Center

Massachusetts Income Tax Calculator Smartasset

New York S Death Tax The Case For Killing It Empire Center For Public Policy

Massachusetts Estate Tax Everything You Need To Know Smartasset

States With No Estate Tax Or Inheritance Tax Plan Where You Die

How Is Tax Liability Calculated Common Tax Questions Answered

New York S Death Tax The Case For Killing It Empire Center For Public Policy

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Massachusetts Estate Tax Everything You Need To Know Smartasset

What Is An Estate Tax Napkin Finance

Massachusetts Estate Tax Everything You Need To Know Smartasset

How Do State Estate And Inheritance Taxes Work Tax Policy Center

How Is Tax Liability Calculated Common Tax Questions Answered

Massachusetts Tax Forms 2021 Printable State Ma Form 1 And Ma Form 1 Instructions

Massachusetts Income Tax H R Block

How Do State And Local Individual Income Taxes Work Tax Policy Center